Healthcare Finance: Navigizing the Complex World of Medical Economics

Healthcare finance is a critical aspect of the broader healthcare system, encompassing the management, allocation, and utilization of financial resources in healthcare organizations and systems. It involves various stakeholders, including government entities, insurance companies, healthcare providers, and patients. Effective healthcare finance ensures that medical services are accessible, affordable, and of high quality. This article explores key concepts, challenges, and innovations in healthcare finance, shedding light on how financial management impacts the delivery of care and the sustainability of healthcare systems.

1. Key Concepts in Healthcare Finance

Revenue Cycle Management (RCM): RCM is the process by which healthcare organizations manage the financial aspects of patient care, from appointment scheduling and insurance verification to billing and collections. Effective RCM helps optimize cash flow, reduce errors, and improve the patient experience.

Cost Accounting: Cost accounting in healthcare involves tracking and analyzing the costs associated with delivering medical services. This includes direct costs, such as salaries and medical supplies, as well as indirect costs, like administrative expenses. Accurate cost accounting helps organizations control expenses and set appropriate pricing for services.

Healthcare Financing Models: Different models of healthcare financing include fee-for-service, capitation, bundled payments, and value-based care. Each model has distinct financial implications for healthcare providers, insurers, and patients, influencing how care is delivered and paid for.

Insurance and Reimbursement: Health insurance plays a central role in healthcare finance by covering the costs of medical care. Reimbursement mechanisms, such as Medicaid, Medicare, and private insurance plans, determine how healthcare providers are compensated for their services.

2. Challenges in Healthcare Finance

Rising Costs: The cost of healthcare continues to rise due to factors such as advanced medical technologies, an aging population, and increased demand for services. Rising costs can strain both public and private healthcare budgets and affect patient affordability.

Access and Equity: Financial barriers can limit access to healthcare for certain populations, particularly those without adequate insurance coverage or with low incomes. Ensuring equitable access to care is a major challenge in addressing disparities in health outcomes.

Insurance Complexity: Navigating the complexities of health insurance, including understanding coverage options, copayments, deductibles, and out-of-pocket expenses, can be confusing for patients. Administrative burdens and insurance denials also impact providers and patients.

Fraud and Abuse: The healthcare sector is susceptible to fraud and abuse, including billing for services not rendered, upcoding, and providing unnecessary treatments. Addressing fraud requires robust oversight, compliance measures, and investigative resources.

3. Innovations and Trends in Healthcare Finance

Value-Based Care: Value-based care models focus on improving patient outcomes and reducing costs by aligning financial incentives with the quality of care provided. This approach emphasizes preventive care, chronic disease management, and coordinated care.

Telemedicine: Telemedicine has emerged as a cost-effective and convenient way to deliver healthcare services. It can reduce the need for in-person visits, lower transportation costs, and improve access to care for remote or underserved populations.

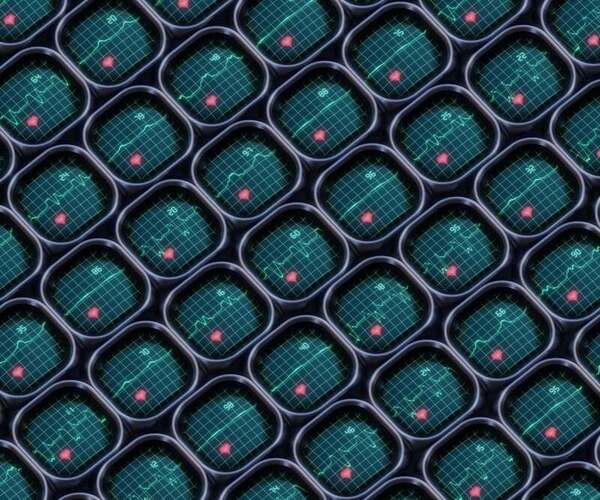

Data Analytics and Health IT: Advances in data analytics and health information technology (IT) enable healthcare organizations to better manage finances, track performance metrics, and make data-driven decisions. Electronic health records (EHRs), predictive analytics, and financial management software are key tools in modern healthcare finance.

Consumer-Driven Healthcare: The rise of consumer-driven healthcare includes the use of high-deductible health plans, health savings accounts (HSAs), and transparency tools that empower patients to make informed decisions about their care and spending.

4. Healthcare Financing Models

Fee-for-Service (FFS): Under the FFS model, healthcare providers are paid for each individual service or procedure performed. While this model offers flexibility, it may incentivize the provision of more services rather than focusing on the overall value and outcome of care.

Capitation: Capitation involves paying a fixed amount per patient over a specific period, regardless of the number of services provided. This model encourages providers to focus on preventive care and efficient management of resources.

Bundled Payments: Bundled payments involve a single payment for a group of related services or procedures, covering all aspects of care for a specific condition or episode. This approach aims to reduce costs and improve care coordination.

Value-Based Care (VBC): Value-based care models tie reimbursement to the quality and outcomes of care. Providers are rewarded for achieving specific health outcomes and improving patient satisfaction while controlling costs.

5. Impact of Policy and Regulation

Affordable Care Act (ACA): The ACA introduced significant changes to healthcare financing, including the expansion of Medicaid, the establishment of health insurance marketplaces, and mandates for coverage of essential health benefits. These reforms aimed to increase access to care and reduce the number of uninsured individuals.

Medicare and Medicaid: Medicare and Medicaid are government programs that provide health coverage to specific populations, including seniors, low-income individuals, and people with disabilities. Changes in these programs' funding and eligibility criteria can have wide-reaching effects on healthcare finance.

Price Transparency: Increasing price transparency is a policy trend aimed at helping patients make informed choices about their healthcare costs. Transparency initiatives require providers and insurers to disclose pricing information and standardize billing practices.

6. Strategies for Improving Healthcare Finance

Cost Control: Implementing strategies to control costs, such as reducing administrative expenses, negotiating better pricing for supplies, and improving operational efficiency, can enhance the financial stability of healthcare organizations.

Patient Engagement: Engaging patients in their own care through education, support, and tools to manage their health can lead to better outcomes and reduced costs. Patient portals, self-management tools, and wellness programs are examples of patient engagement strategies.

Alternative Payment Models: Exploring alternative payment models, such as accountable care organizations (ACOs) and patient-centered medical homes (PCMHs), can improve care coordination and cost management.

Financial Literacy: Improving financial literacy among healthcare professionals and patients can lead to better financial decision-making. Training and resources that enhance understanding of healthcare finance, insurance, and budgeting can empower stakeholders to navigate the system more effectively.

Conclusion

Healthcare finance is a complex and evolving field that plays a crucial role in shaping the quality, accessibility, and sustainability of medical care. By understanding the key concepts, challenges, and innovations in healthcare finance, stakeholders can work towards creating a more efficient and equitable healthcare system. Addressing financial issues, implementing effective strategies, and embracing new trends can help improve patient outcomes, control costs, and ensure that healthcare remains accessible and affordable for all.